GETTING A HOME LOAN SHOULDN’T BE HARD

SEE HOW SIMPLE IT IS

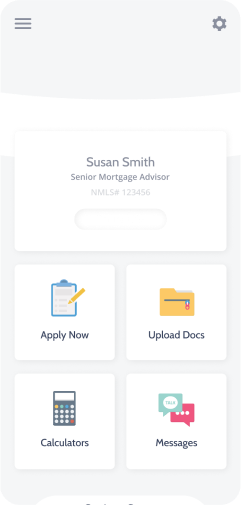

This website guides you through your mortgage financing and connects you directly to your Mortgage Consultant. You will create your own logon and password and will updates through the process.. HOWEVER you are not required to use the electronic process, we would LOVE to meet you in person at our office and discuss fully your situation. IF you would prefer to only do everything in person or over the phone, please call us to schedule an appointment.. By filling out the application on this website it just speeds the process along and gets the paperwork part of the process out of the way, which allows us time to discover the best possible options for you - when we and/or talk on the phone or meet in person.

MORTGAGE PAYMENT CALCULATOR Calculate how much your monthly mortgage payment could be.

* Results are hypothetical and may not be accurate. This is not a commitment to lend nor a preapproval. Consult a financial professional for full details.

FHA, VA, and Conventional Loans in Ogden, UT

Welcome to the official site of Talon Loans, LLC. We are a full-service mortgage company based in Ogden, UT. We specialize in FHA, VA, USDA, Conventional, and First Time Homebuyer Loans in Ogden, Layton, and Morgan. We also serve the surrounding cities in Weber, Davis, and Morgan. Whether buying a home or refinancing in any of these zip codes: 84403, 84050, or 84414, we can help you realize your dream of home ownership or save you money when getting your new lower monthly payment.

In terms of Purchase Loan programs, we offer the following:

Refinancing? We can help you with that, too!

We offer a wide range of refinance options designed to meet the needs of local borrowers best. If you're looking for cash out or to get a better rate and term, we can assist you. We offer the following Refinancing Programs:

What makes Talon Loans, LLC unique is that we offer the following niche programs as well: Down Payment Assistance, Stated Income, Bank Statement Loans, DSCR, and Foreign Nationals.

Contact Talon Loans, LLC today to discuss your mortgage loan options and find out which loan program will best suit your needs.